National Bank of Malawi Pension Administration Limited (NBM PAL), a subsidiary of NBM plc, says the myriad restrictions on local pension funds to invest on offshore markets are impeding business progress.

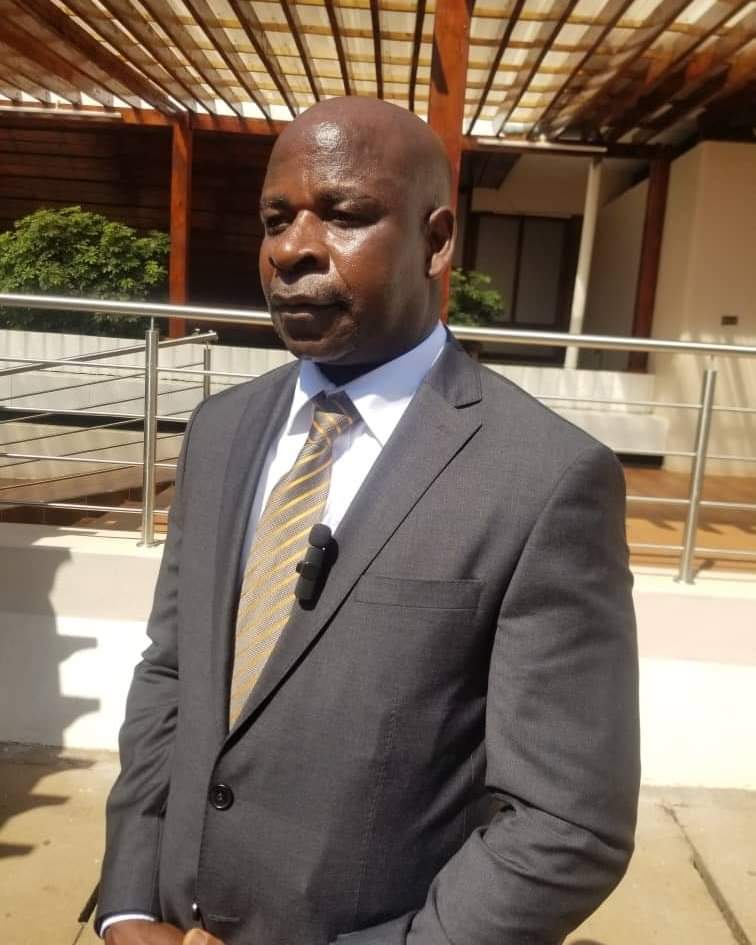

William Mabulekesi, NBM PAL Chief Executive Officer (CEO) made the remarks in Lilongwe after a stakeholders’ meeting on pension that explored how offshore markets have been hampered by ongoing scarcity of foreign exchange.

Said Mabulekesi: “Beyond the fact that there are restrictions on pension funds to invest outside the country to protect the savings for pension contributors the Reserve Bank of Malawi has toughned the rules on foreign exchange controls use due to scarcity.”

Mabulekesi, however, said NBM PAL is looking at best possible ways to make more investments in the forex generating areas to ensure increased returns for the pension funds contributors.

The NBM PAL boss explained that on its investment portifolio, his firm has a well-spread base in interest bearing assets, shares on the stock market and property which yield high returns.

Afro Egypt Engineering Group representative, Shunga Nyoni, whose firm is one of the investors in NBM PAL, said the investment returns have so far been encouraging.

Said Nyoni: “We want to have good returns on our pension funds and we are impressed.”

The United States Department of State is on record as saying that Malawi’s investment climate does not incentivise or promote outward investment.

“The Pension Act and accompanying regulations prohibit domestic investors from investing pension funds or umbrella funds in foreign schemes,” reads brief in part.

NBM PAL Unrestricted Pension Fund last year registered an increase in investment income for the year, 2023 to 42 percent from 27 percent in the previous year, 2022.

Therefore, this means that, for example, for an individual member with a total accumulated pension benefit of K10 million as of December 31 2023, the total accrued pension benefit has increased to K14.2 million with effect from January 1 2024.

Mabulekesi said with inflation averaging 30 percent in 2023, members are poised to get a real investment return of over 12 percent.

“We want to have good returns on our pension funds and we are impressed.”

Shunga Nyoni

Representative

Afro Egypt Engineering Group