As Malawi continue to grapple with a challenging macroeconomic outlook, the south-east African nation is swimming in the deep-ends of the debt-ocean to the tune of a mind-boggling K13.1 trillion, it has been established.

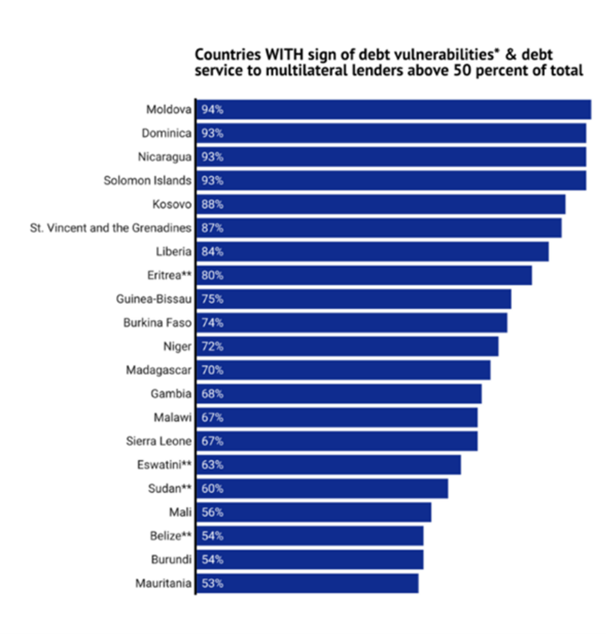

With a concerning debt of over K13 trillion representing a debt-to-GDP ratio of 85%, Malawi is fast approaching a serious debt crisis.

Ecomists and financial experts are urging the Malawi Government to take urgent action in order to prevent a catastrophic economic turmoil.

According to new data, as of December 2023, the country’s debt has gone up from K9.3 trillion the previous year, propelling the debt-to-GDP ratio to a worrying 85% of the country’s GDP.

The Ministry of Finance and Economic Planning has attributed the worsening debt levels to the devaluation of the kwacha and the conversion of short-term domestic borrowing (Treasury Bills) to long-term facilities (Treasury Notes).

However, financial and economic captains have warned that the country’s debt situation is unsustainable, with possible continued high levels of borrowing on the horizon as the economy struggles to generate sufficient revenue to meet the Treasury’s needs.

Challenging

The experts are urging the government to take immediate action to address the debt crisis, including implementing austerity measures and seeking alternative sources of revenue to reduce the country’s reliance on borrowing.

According to a report by the Centre for Social Concern (CfSC), Malawi’s public debt sustainability is under threat due to rising debt pressure and a lack of economic growth to support revenue needs.

The report, presented by financial expert and CfSC consultant Lesley Mkandawire, warns that the country’s debt situation will continue to deteriorate unless drastic measures are taken to address the issue.

“Some drastic measures have to be urgently taken or things will get worse,” cautions Mkandawire.

Secretary to the Treasury Betchani Tchereni says the Malawi government has resorted to only take or guarantee concessional debt.

“Let it be known that government, led by President Chakwera, will continue to engage for debt cancellation.

“We hope other stakeholders such as civil society will join us in this endeavor for the good of the country,” he said.

Real GDP growth is projected to recover to a below-trend 1.6 percent in 2023, as Malawi has continued to face protracted balance of payments challenges, including shortages of foreign exchange, and a hit to agriculture output as a result of Cyclone Freddy.

Inflation remains elevated, at 27.8 percent in September, driven in large part by food inflation, at 36.8 percent; even as global price pressures ease and money growth levels off.

The Reserve Bank of Malawi (RBM) raised interest rates by a further 200 basis points, to 24 percent, in August.

But inflation is projected to remain well above target this year and next; at 30.3 percent and 27.9 percent, on average, respectively.

Unsustainability

Malawi’s external debt is presently unsustainable and if the debt restructuring strategy were to be executed successfully, alongside implementation of the envisioned macroeconomic adjustment, it would be considered sustainable on a forward-looking basis.

According to the International Monetary Fund (IMF) Managing director, Kristalina Georgieva, a successful debt treatment of commercial and official bilateral debt in line with the authorities’ strategy would significantly reduce near-term debt service and bring the relevant solvency and liquidity indicators below their respective thresholds by 2028 or sooner.

Says the IMF Chief : “This would bring Malawi back to moderate risk of external debt distress over the medium term.”

Malawi’s exports are highly concentrated and vulnerable to weather and climate-related shocks, while the exchange rate could also be buffeted by domestic and external shocks.

Mitigating the former risk somewhat is the fact that Malawi has typically received steady and predictable aid flows in foreign currency, not accounted for in the calculation of the DSA’s liquidity indicators.

Estimates

In the 2023/24 budget presented to the August House just over a week ago, the country’s total expenditure for the coming financial year is projected at MK3.87 trillion, translating into 25.5% of our current Gross Domestic Product (GDP) estimates.

It is worth pointing out that only MK0.89 billion of this amount is budgeted for development expenditure.

On the other hand, total expected inflows for the year, including grants, are estimated at around MK2.55 trillion, representing 16.8% of GDP.

This entails that should all projections hold true, Malawi will add an estimated MK1.32 trillion to its debt stock in the 2023/2024 financial year.

This is roughly 8.7% of GDP which, although a 0.01% improvement from this year’s expected 8.8%, still entails a significant increase in nominal terms from a deficit of around MK1.01 trillion, which itself was against an approved deficit of only MK0.88 trillion.

For context, at the moment of tabling this fiscal plan, Malawi public debt stock stands at an estimated MK7.90 trillion, translating into 69.93% of GDP.

In the current budget, interest payments on public debt alone has been estimated at MK0.91 trillion or 6% of GDP, an increase of MK0.27 trillion from just the previous year alone.

Of the total debt stock, MK3.47 trillion is actually external debt, with capital and interest repayments denominated in foreign exchange that the country simply does not have.

“This would bring Malawi back to risk of external debt distress.”

Kristalina Georgieva

IMF Managing director