Across the globe, no financial sector can resist technological disruptions and survive and the pace in embracing technological changes in the insurance industry has been slow globally, however, this trend is changing gradually.

And, the Warm heart of Africa is not lagging behind – it is at the double, pacing and racing to catch up.

The insurance industry in Malawi has experienced steady growth over the years despite the challenges such as a decline in economic growth and inflation, which have affected the purchasing power of would-be clients of the insurance companies.

Worldwide, the players within the insurance industry have been upbeat in adopting new innovative ways of conducting insurance business to enhance efficiency in service delivery alongside other reasons like fraud mitigation

It is against this background, the Insurance Association of Malawi (IAM) has set 1st January 2025 as the day only digital motor insurance will be accepted on the roads of Malawi.

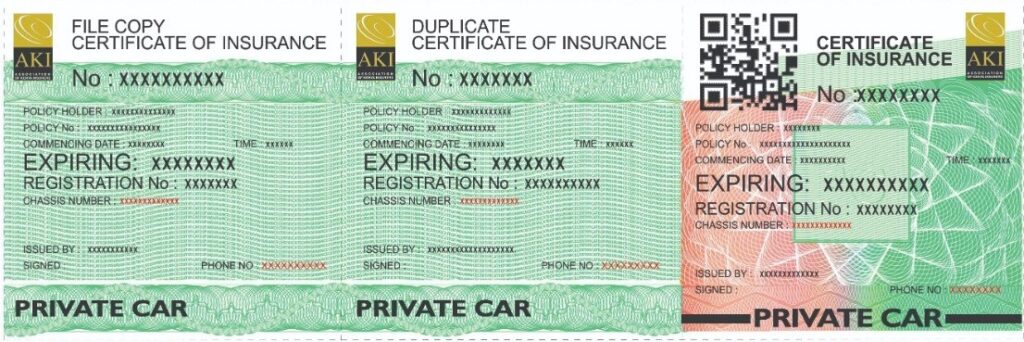

IAM introduced the digital insurance certificates in October 2023 and has set December 31, 2024 as the last day for motorists to use the pre-printed insurance certificates.

The new certificate is digital and is being issued online, with verification through digital processes.

“The new certificates are also capable of integrating with other systems, such as Maltis, NRB, and banks, to make business transactions more efficient,” said Meja.

IAM vice president, Wales Meja said in an interview yesterday, that they introduced digital motor certificates to address emerging trends like ensuring that all insurance companies use a unified system and database which makes data verification easier.

“It is also a way of supporting the initiative to digitise the Malawi economy, apart from eliminating fraudulent motor certificates through digital verification, and preventing forgery.

“The digital certificates also enable insurance companies, and agents to sell online 24/7. It also makes it easy for law enforcement agencies to detect stolen vehicles during spot checks.”

Meja, who is also Chief Executive Officer (CEO) for Britam, then commended motorists for embracing the new digital certificates, but asked them to install a mobile application downloaded from Play Store or App Store, and also use USSD code *4273* to authenticate the certificates.

Mzuzu-based motorist, Gift Mnami commended IAM for the initiative saying it is fast and convenient to access the digital certificates online.

“This system enables us to access certificates online, significantly reducing the time and costs previously spent visiting insurance companies,” he said.

The digital insurance certificate, which is displayed on the windscreen, similar to the Certificate of Fitness (COF), has features like the certificate number, vehicle registration number, vehicle chassis number, make and model of the vehicle, vehicle colour, vehicle seating capacity, picture of the vehicle’s body type, insurance policy duration, policy issue date, policy number, policy holder, insurance cover type, and vehicle usage.

Apart from guaranteeing payment in the event of losses, digital insurance systems provide a myriad of benefits – both social and economic –to a country’s economy and the society as a whole.

One of the most significant benefits of digital insurance transformation is that businesses will be able to collect and analyse data that can turn into actionable, revenue-generating insights.

Before digitalisation, data was scattered across multiple disconnected platforms, or even worse, we might not have collected and used data at all.

Insurance digital transformation will enable robust data collection, centralized data storage, and the creation of tools to analyse and translate data into information that promotes informed corporate decision-making.

“This system enables us to access certificates online, significantly reducing time and costs.”

Gift Mnami

Mzuzu-based motorist,