One of Africa’s leading commercial bankers, commonly known as bank of the nation, National Bank of Malawi (NBM) plc has partnered with Sky Energy Africa and 265 Energy to offer financing for electric cars and other energy solutions that are easy, flexible and affordable.

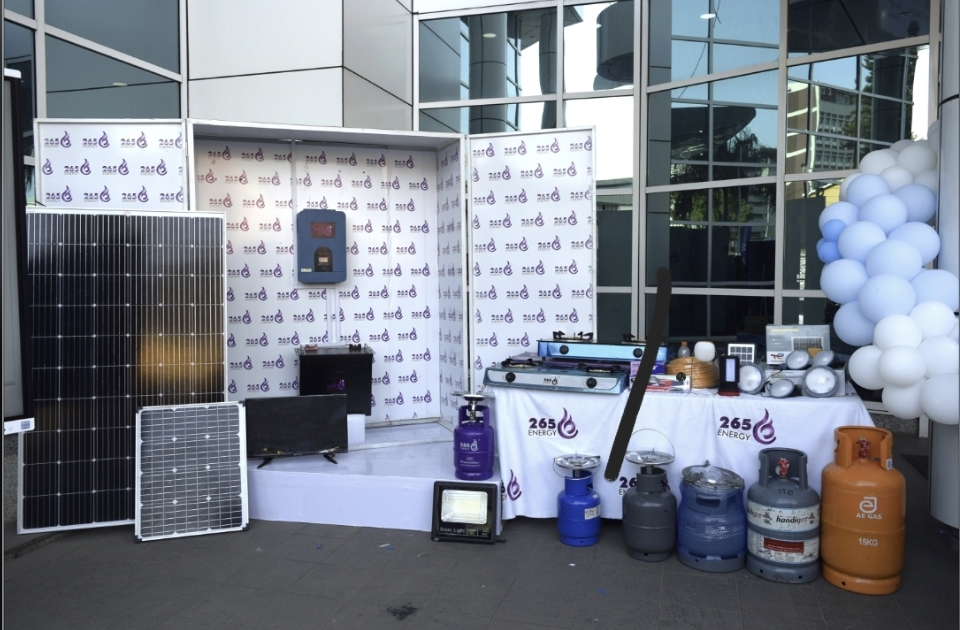

Through the partnership, NBM plc customers will be able to access financing for electric vehicles at Sky Energy Africa, and solar and gas solutions at 265 Energy.

Speaking after signing the Memorandum of Understanding (MOU) with the two companies on Tuesday, NBM plc Head Retail Banking Division Oswin Kasunda said that the partnership will help ease customers’ access to the products.

“These are young and upcoming companies that are offering energy solutions in Malawi that is why we have seen it necessary to partner with them.

“As a country is driving clean energy solutions, we thought that we must be part and parcel of supporting this initiative to make sure that customers have access to these products so that we can also manage environmental related problems,” said Kasunda.

On the loan payment period for the two products, Kasunda said the Bank is flexible depending on the customer’s affordability.

“For a car, one can go up to five years, but that is just the maximum payment period. If one thinks they can manage to pay in 12 months there is no problem.”

“Borrowing is all about affordability, a customer can come whether they want a small amount for a small product or a customer want to buy an electric vehicle since we do not have borrowing limits,” explained Kasunda.

Founder and Managing Director of Sky Energy Africa, Schizzo Thomson commended NBM plc for the partnership saying it gives a chance to people and organisations to acquire the electric vehicles which promotes the adoption of sustainable energy technologies.

“There has always been a challenge in-terms of initial investment for one to be able to acquire energy products even the electric vehicles, this partnership closes this gap as clients will be able to access these vehicles and other products through loans.”

“When the electric vehicles were launched, there were thousands of enquiries, people trying to understand the solutions but the limiting factor for escalation to the adoption has been the cost of the vehicles which the NBM Plc is now trying to solve,” explained Thomson.

In his remarks 265 Energy Chief Executive Officer, Mfundo Mbvundula also said the partnership ensures that access to solar and gas solutions has been simplified.

“Through this initiative the Bank takes the upfront cost and the customer can repay the bank over months or a year based on the price and what they discuss with the Bank.

“This will make it more affordable for the customer to get good quality solutions from us,” explained Mbvundula.

“These are young and upcoming companies that are offering energy solutions in Malawi.”

Oswin Kasunda

NBM plc Head Retail Banking Division